Compound Interest Calculator India Daily, Monthly, Quarterly

To earn interest on interest one has to immediately reinvest the interest earned. But in compounding this happens automatically with no extra effort needed. Let the magic of compounding work for you by investing regularly and staying invested for long horizons and increasing the frequency of loan payments.

How to use the ClearTax Compound Interest Calculator?

Scripbox offers a monthly compound interest calculator, quarterly compound interest calculator, semi-annual compound interest calculator, and annual compounding calculator. If you make a sound investment, compound interest can help you to build your wealth over time. But if your debt is subjected to compound interest, then it can cause financial hardship if not planned. To understand how compound interest works, let us break down the process of how your investment can compound better.

- The power of compounding has been said to be phenomenal by the likes of Warren Buffet.

- To start, you need to know how much money you have to invest upfront.

- Compound interest holds substantial importance in the context of financial planning too.

- We offer a wide range of innovative services, including online trading and investing, advisory, margin trading facility, algorithmic trading, smart orders, etc.

- Frequency of compounding is basically the number of times the interest is calculated in a year.

Check how much you can earn with Power of Compounding

If it is not enough, you can check if you can increase your investment amount or find an investment option that offers a higher interest rate. Obviously, it is difficult to calculate these amounts manually or even using the formula especially when you have longer tenures. That is why you need a compound interest calculator online in India by Angel One to make the task easier. In the case of daily compounding, the interest is compounded every day for the entire year. Due to this, the principal amount increases each day, thus leading to higher returns.

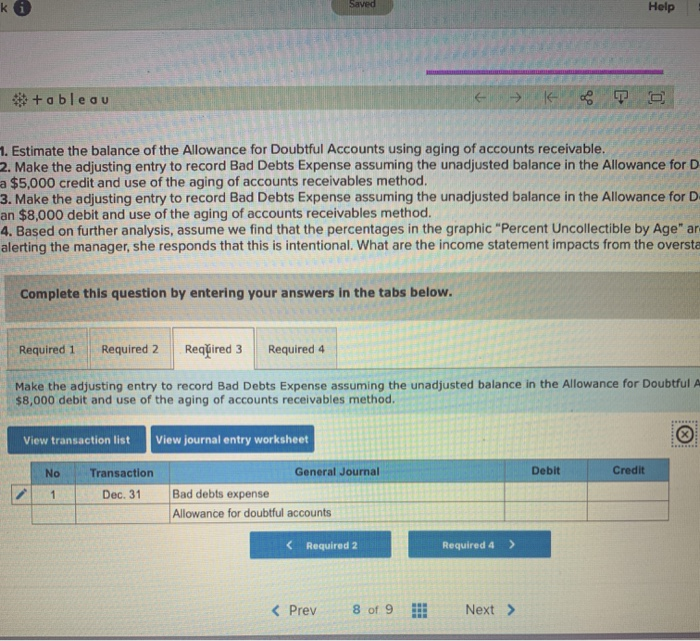

Compounding Intervals

This is because it helps individuals be aware of the power of compounding, thus encouraging them to make well-informed and intelligent investment decisions. Computes the future value of investments based on principal amount, interest rate, and compounding frequency. The longer you leave your money untouched, the greater it will grow because compound interest grows over time which means your money keeps on multiplying over a period of time. If you are repaying a loan on compound interest, you should not ignore paying the interest or if there is any delay in paying the loan, then the interest burden will be high. virtual metaverse plots outpace top nft collection sales play To take advantage of compounding, one must aim at increasing their frequency of loan payments.

It helps to choose the right investment tool, period for your investment and make your financial planning better. You can use the Compound Interest Calculator from the comfort of your home. It is an easy to use tool where you enter the compounding frequency, principal amount, interest rate and the period. The ClearTax Compound Interest Calculator shows the interest you earn on the deposit in seconds.

What are the advantages of using a compound interest calculator?

The power of compounding effects results in exponential growth, allowing your money to work harder for you. In the case of monthly compounding, the interest is compounded 12 times a year, that is, once every month. Monthly compounding provides better returns as compared to yearly compounding.

At this point, the interest is added to the initial investment amount. When it earns interest again, it will determine the newly earned interest by calculating the initial capital invested and the earned interest. Save taxes with Clear by investing in tax saving mutual funds (ELSS) online. Our experts suggest the best funds and you can get high returns by investing directly or through SIP. Download Black by ClearTax App to file returns from your mobile phone.