Say you have a total of $70,000 in accounts receivable, your allowance for doubtful accounts would be $2,100 ($70,000 X 3%). If the doubtful debt turns into a bad debt, record it as an expense on your income statement. Yes, GAAP (Generally Accepted Accounting Principles) does require companies to maintain an allowance for doubtful accounts. According to GAAP, your allowance for doubtful accounts must accurately reflect the company’s collection history.

- The estimated bad debt percentage is then applied to the accounts receivable balance at a specific time point.

- While the allowance for doubtful accounts is a useful accounting method that can help assess the true value of the accounts receivable asset, it has shortfalls that need to be considered.

- This amount is referred to as the net realizable value of the accounts receivable – the amount that is likely to be turned into cash.

- It can also help you to estimate your allowance for doubtful accounts more accurately.

How to calculate bad debt expenses using the allowance method

For the taxpayer, this means that if a company sells an item on credit in October 2018 and determines that it is uncollectible in June 2019, it must show the effects of the bad debt when it files its 2019 tax return. This application probably violates the matching principle, but if the IRS did not have this policy, there would typically be a significant amount of manipulation on company tax returns. For example, if the company wanted the deduction for the write-off in 2018, it might claim that it was actually uncollectible in 2018, instead of in 2019.

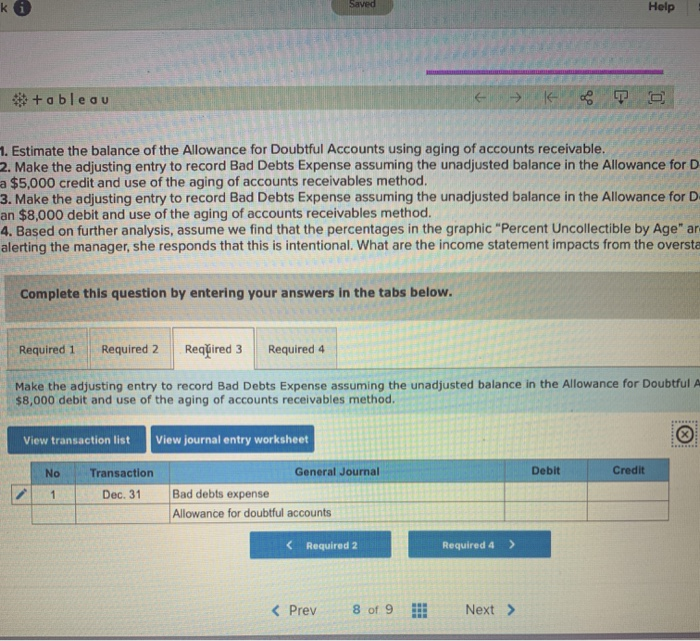

Balance Sheet Aging of Receivables Method for Calculating Bad Debt Expenses

With this method, accounts receivable is organized intocategories by length of time outstanding, and an uncollectiblepercentage is assigned to each category. For example,a category might consist of accounts receivable that is 0–30 dayspast due and is assigned an uncollectible percentage of 6%. Anothercategory might be 31–60 days past due and is assigned anuncollectible percentage of 15%.

Streamline your accounting and save time

The risk method is used for the larger clients (80%), and the historical method for the smaller clients (20%). It’s important to note that an allowance for doubtful accounts is simply an informed guess, and your customers’ payment behaviors may not align. When assessing accounts receivable, there may come a time when it becomes clear that one or more accounts are simply not going to be paid. Companies create an allowance for doubtful accounts to recognize the possibility of uncollectible debts and to comply with the matching principle of accounting.

Risk Classification Method

For example, a company might opportunistically reduce the allowance in a period of reduced earnings. That percentage can now be applied to the current accounting period’s total sales, to get a allowance for doubtful accounts figure. Another way you can calculate ADA is by using the aging the standard deduction of accounts receivable method. With this method, you can group your outstanding accounts receivable by age (e.g., under 30 days old) and assign a percentage on how much will be collected. If you use double-entry accounting, you also record the amount of money customers owe you.

The entry for bad debt wouldbe as follows, if there was no carryover balance from the priorperiod. The various methods can be classified as either being an income statement approach or a balance sheet approach. With an income statement approach the bad debt expense is calculated, and the allowance account is the balancing figure.

Our expert tax report highlights the important issues that tax preparers and their clients need to address for the 2024 tax year. Stay informed and proactive with guidance on critical tax considerations before year-end. In this post, we explain the importance of ADA, how to calculate it, where to record it, and more. Recovering an account may involve working with the debtor directly, working with a collection agency, or pursuing legal action.

Though the Pareto Analysis can not be used on its own, it can be used to weigh accounts receivable estimates differently. For example, a company may assign a heavier weight to the clients that make up a larger balance of accounts receivable due to conservatism. Bad Debt Expense increases (debit), and Allowance for DoubtfulAccounts increases (credit) for $22,911.50 ($458,230 × 5%).

The aging of accounts receivable method is another balance sheet approach and is a refinement of the percentage of accounts receivable method discussed above. If 6.67% sounds like a reasonable estimate for future uncollectible accounts, you would then create an allowance for bad debts equal to 6.67% of this year’s projected credit sales. Self-insuring by using allowances for doubtful accountsbad debt reserves may come without a direct cost, but it offers limited benefits in the event of a catastrophic loss.

Deje su comentario