An accountthat is 90 days overdue is more likely to be unpaid than an accountthat is 30 days past due. As the accountant for a large publicly traded food company, youare considering whether or not you need to change your bad debtestimation method. You currently use the income statement method toestimate bad debt at 4.5% of credit sales. Thiswould split accounts receivable into three past- due categories andassign a percentage to each group. The allowance method is considered a less aggressive and, in some industries, more acceptable method for writing off debt. It relies on the premise that the amount of bad debt can be accurately estimated based on historical accounting data.

Income Statement Method for Calculating Bad Debt Expenses

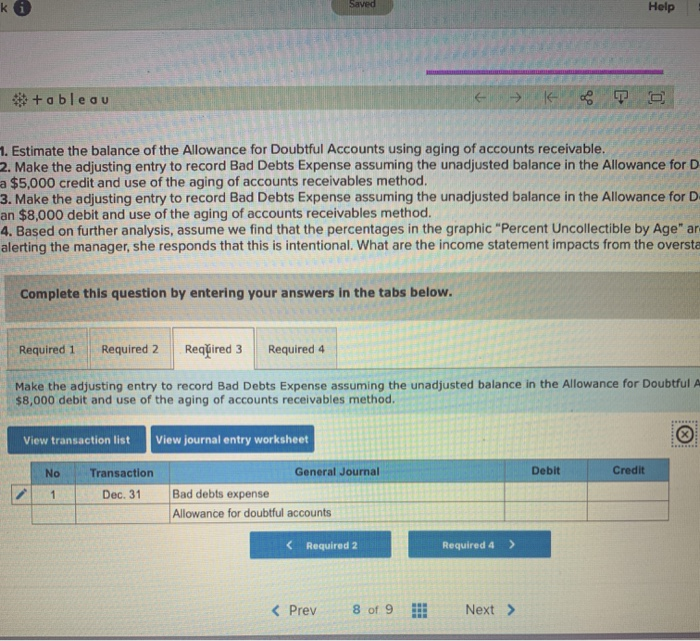

After figuring out which method you’ll use, you can create the account in the chart of accounts. As a result, the estimated allowance for doubtful accounts for the high-risk group is $25,000 ($500,000 x 5%), while it’s $15,000 ($1,500,000 x 1%) for the low-risk group. Thus, the total allowance for doubtful accounts is $40,000 ($25,000 + $15,000). Let’s explore the importance of allowance for doubtful accounts, the methods of estimating it, and how to record it. Businesses can use the proper methods to estimate the AFDA to ensure their balance sheets remain accurate and up-to-date.

Accounts receivable aging method

For detailed expectations and guidelines related to write offs, see Writing Off Uncollectable Receivables. The three example corporations, Dell, Apple and Cisco—all manufacturers in the high-tech industry—exhibit very different patterns when estimating collectibility and establishing allowances. Ideally, you’d want 100% of your invoices paid, but unfortunately, it doesn’t always work out that way.

Heating and Air Company

For example, it has 100 customers, but after assessing its aging report decides that 10 will go uncollected. The balance for those accounts is $4,000, which it records as an allowance for doubtful accounts on the balance sheet. This method works best for companies with a small number of customers who’ve been doing business with you for a while. For businesses with a large number of constantly changing clients, using the customer risk classification would be difficult because you wouldn’t have historical data on every client. The allowance for doubtful accounts helps you see the true value of your assets.

Steps to Quickly Build Small Business Credit

- For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

- Continuing our examination of the balance sheet method, assumethat BWW’s end-of-year accounts receivable balance totaled$324,850.

- To break it down further, take a look at how both approaches compare for various aspects of your business.

- Then, in February 2023, the CFO informs you that the company filed for bankruptcy and won’t be able to pay the amount they owe.

- The previous allowance method directly estimated the bad debt expense based on the credit sales recorded on the income statement of the business.

Remember, unpaid invoices weaken your cash flow and those additional costs will add up quickly. Utilizing an allowance for doubtful accounts if a customer doesn’t pay also requires more internal resources to manage the risk. Use the comparison chart below to see how much you might be costing your business. Let’s say your business brought in $60,000 worth of sales during the accounting period. Based on historical trends, you predict that 2% of your sales from the period will be bad debts ($60,000 X 0.02).

Allowance for doubtful accounts: Methods & calculations

In particular, your allowance for doubtful accounts includes past-due invoices that your business does not expect to collect before the end of the accounting period. In other words, doubtful accounts, also known as bad debts, are an estimated percentage of accounts receivable that might never hit your bank account. For example, say over the past five years, 2% of your company’s credit sales haven’t been collectible. So each accounting period, you would enter 2% of that period’s credit sales as a debit to bad debt expense.

Using this allowance method, the estimated balance required for the allowance for doubtful accounts at the end of the accounting period is 7,100. At the end of an accounting period, the Allowance for Doubtful Accounts reduces the Accounts Receivable to produce Net Accounts Receivable. Note that allowance for doubtful accounts 110 tax humor ideas reduces the overall accounts receivable account, not a specific accounts receivable assigned to a customer. Because it is an estimation, it means the exact account that is (or will become) uncollectible is not yet known. This is where a company will calculate the allowance for doubtful accounts based on defaults in the past.

When a specific customer has been identified as an uncollectibleaccount, the following journal entry would occur. There is one more point about the use of the contra account,Allowance for Doubtful Accounts. In this example, the $85,200 totalis the net realizable value, or the amount of accounts anticipatedto be collected.

After an amount is considered not collectible, the amount can be recorded as a write-off. This means the business credits accounts receivable and debits the bad debt expense. The percentage of sales method assigns a flat rate to each accounting period’s total sales. Using previous invoicing data, your accounting team will estimate what percentage of credit sales will be uncollectible. This is different from the last journal entry, where bad debtwas estimated at $58,097.

Deje su comentario